Continua mejorando el mercado Inmobiliario de Texas, para inversionistas extranjeros

El Dallas Monrning News, ha publicado una interesante nota sobre el creciente número de inversionistas en bienes raíces que miran con renovado interés a Texas como lugar para este tipo de inversiones.

Desde BuniesssBeachHead, con nuestro servicio REY (Real Estate for You), podemos asesorarlo para que pueda maximizar sus inversiones inmobiliarias.

A continuación, la nota:

Buyers hunting a home aren’t just competing with house flippers and investors.

Nationwide, the number of foreign buyers in the home market has surged to a record high in the last year and Texas is one of their favorite destinations.

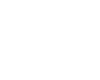

International buyers purchased more than $153 billion in U.S. residential properties in the 12-month period ending in March, according to an annual study by the National Association of Realtors. That was a 49 percent increase in dollar volume from sales to foreign buyers in the previous year.

The biggest rise in U.S. homebuying came from Canadian purchasers, the Realtors said.

International buyers snapped up 284,455 U.S. properties — a 32 percent hike from 2016. More than 34,000 of the purchases were in Texas.

«The political and economic uncertainty both here and abroad did not deter foreigners from exponentially ramping up their purchases of U.S. property over the past year,» Lawrence Yun, NAR chief economist, said in a statement. «While the strengthening of the U.S. dollar in relation to other currencies and steadfast home-price growth made buying a home more expensive in many areas, foreigners increasingly acted on their beliefs that the U.S. is a safe and secure place to live, work and invest.»

Buyers from China spent the most on U.S. housing — some $31.7 billion. The largest share of their 40,572 purchases — 37 percent — were in California. Texas was their second favorite U.S. home market accounting for 11 percent of their deals.

Texas has been on foreign buyers’ radar screen for decades.

«From talking to Realtors and other we know they are doing a lot of business with foreign buyers,» said Dr. James Gaines with the Real Estate Center at Texas A&M University. «Texas represents a very nice opportunity for them – we’ve been the fastest growing state in the country for years.»

Gaines said that he isn’t surprised Chinese investors like the Lone Star State.

«The Chinese are very entrepreneurial and Texas is a very entrepreneurial state,» he said. «We have a lot of Asians relocating to Texas.»

He said the true number of foreign property buyers in Texas and the U.S. can be hard to track.

«When somebody buys a piece of property, a foreign buyer has to register,» Gaines said. «A lot of foreign buyers form U.S. corporations to avoid the disclosure.»

Canadian buyers spent $19 billion on U.S. homes, followed by buyers from the United Kingdom ($9.5 billion), Mexico ($9.3 billion) and India ($7.8 billion).

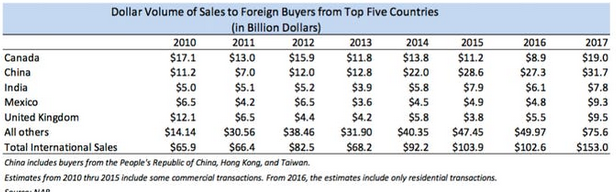

Florida had the largest percentage of off-shore sales — about 22 percent of U.S. totals. California and Texas were tied with 12 percent shares of total international purchases.

While the Realtor report did not break out data on the metro area level, traditionally Houston and San Antonio have had some of the highest Texas volumes of home sales to offshore buyers.

The Realtors said the greatest volume of Texas’ foreign home buys — about 40 percent — came from Mexican and Latin American purchasers. Asian buyers were a close second with 39 percent of the offshore acquisitions.

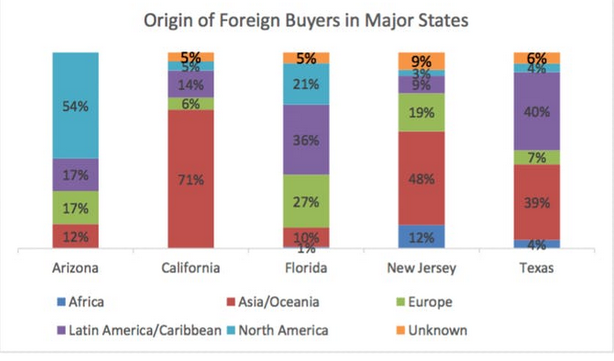

More than 40 percent of total U.S. purchases by Mexican buyers were in Texas. Texas also accounted for about 10 percent of total U.S. home purchases by buyers from India.

Out of the $153 billion in home buys, the Realtors estimate that about $75 billion were by non-occupant owners as investors.

The median price of homes sold to international buyers in the last year was $302,290, which is higher than the nationwide median sales price of about $236,000. Buyers from China paid the most with a median sale price of almost $530,000.

About 44 percent of foreign home buys were all cash deals, the Realtors found.

Almost half of the buyers said they planned to use the property as their primary residence.

The Realtors said that rising prices in some foreign markets — particularly in Canada — may be prompting the increase in U.S. purchases.

«Inventory shortages continue to drive up U.S. home values, but prices in five countries, including Canada, experienced even quicker appreciation,» said Yun. «Some of the acceleration in foreign purchases over the past year appears to come from the combination of more affordable property choices in the U.S. and foreigners deciding to buy now knowing that any further weakening of their local currency against the dollar will make buying more expensive in the future.»

The Realtors say that foreign buys in the last year may represent a peak.

«Realtors in some markets are reporting that the effect of tighter regulations on capital outflows in China and weaker currencies in Canada and the U.K. have somewhat cooled non-resident foreign buyer interest in early 2017,» Yun said.

«Stricter foreign government regulations and the current uncertainty on policy surrounding U.S. immigration and international trade policy could very well lead to a slowdown in foreign investment.»

Fuente: Dallas Morning News